The filter market has a bright future

The future world is a wireless connection to all the world. According to Gartner predicts that by 2020, networking equipment will reach 25 billion, to achieve the global average of three people the size of network equipment. As an indispensable part of the wireless connection, the RF front-end technology innovation is one of the core engines that drive the wireless connectivity forward. In the wireless networking terminal equipment from 2015 to 3.6 billion to 25 billion trend, the RF front-end device will increase the annual output value several times.

Filter is the RF front-end market, the largest business segment, the filter's main role is to transmit and receive signal filtering, the signal can be a specific frequency components through, and greatly attenuate the other frequency components, reduce the interference of the signal The In a radio frequency circuit, the role of the filter is to allow a specific frequency of the signal through, and then try to suppress other frequencies of signal interference. Usually the frequency of 1900Mhz below the frequency of SAW, the higher frequency band with BAW.

SAW is a surface acoustic wave filter, at the input by the piezoelectric effect of the wireless signal into an acoustic signal on the surface of the media propagation, the output by the reverse piezoelectric effect of the acoustic signal into a wireless signal. SAW filter set low insertion loss and good suppression performance in one, not only can achieve wide bandwidth, its volume is still much smaller than the traditional cavity and even ceramic filter, but because of SAW filter has limitations. , Higher than 1Ghz, the selective reduction in the 2.5Ghz, it can only meet the performance requirements of the application is not high, this time on the need for BAW.

In general, the phone for each support a band, you need to add two filters were used to receive and send signals, the current market common 5-mode 13-band 4G mobile phone, in addition to the 2/3 / 4G signal Send and receive filtering, but also need to Wi-Fi, Bluetooth, GPS signal filtering, so a phone about 30 or so for different bands of the filter. Therefore, in order to use such a number of filters in a limited mobile space, it is necessary to integrate the filters of these different operating frequency bands.

As far as the LTE R11 version of 3GPP proposed by the Global 3G Standards Association in 2012, the number of bands supported by cellular communications systems has increased to 41. In the future, the RF filter market will usher in more growth. With 4G mature and 5G coming, 3GPP version will be upgraded to R16, mobile phone support the number of bands increased significantly.

Now, the cost of RF devices in mobile phones is getting higher and higher, a 4G full Netcom phone, front-end RF chip cost has reached 8-10 dollars, containing 6-10 filters. The future with 5G arrival, RF kit cost is likely to exceed the main chip of the phone. And the outbreak of things, it is the RF devices, especially the demand for filters to add fuel to the flames.

With the 4.5G network and 5G network landing, mobile communication frequency band will increase significantly (generally need to be backward compatible), driven by the demand for filter growth. Specifically: 2G to 4G, the common frequency band from 4 to nearly 20 (need to be backward compatible), the number of mobile phone filters from just a few to the whole version of the network version of IPhone6S 40, the future 5G demand will Bigger. While considering the Internet of things access, other new near-field connection, filter demand will increase.

Filter opportunities and challenges

1, unprecedented opportunities

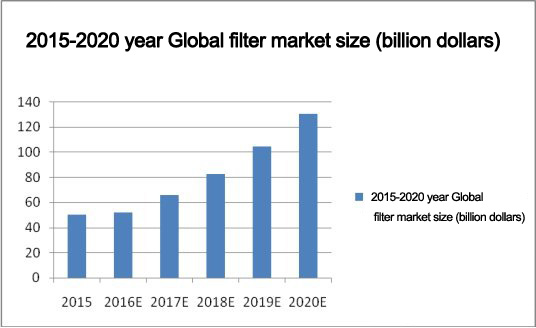

At present, the terminal filter market demand doubled, driving factors mainly from several aspects: 1,4G mobile phone market in the overall penetration rate increase; 2,4G technology evolution (including carrier aggregation), the relevant band continues to increase; 3 , The Internet of things to broaden the horizontal market; 4,5G potential band and access to the upgrade. 2015 SAW filter only global market of 20 billion US dollars, is expected to 2016 more than 3 billion US dollars, the market growth rate of more than 50%, taking into account the BAW filter and 2018 5G band gradually divided, the market space will be doubled increase.

By 2020, the value of the filter unit phone or more than 5 US dollars / Department (the current 4G mobile phone about 3.75 US dollars / min), corresponding to the market nearly 10 billion US dollars, is expected to more than 50 billion yuan. So the market demand driven to become the core of the filter industry growth logic, the relevant drivers may gradually promote the future market space growth.

Filter market because of the need for technical accumulation and market space reasons, the competitive landscape for the oligarchs. From the shipments of the situation, the US manufacturers Avago, Qorvo, Skyworks and Japanese manufacturers TDK, Murata, the sun as the main manufacturers. One of the US manufacturers have to provide front-end module solutions and provide the ability to provide BAW filter, the Japanese manufacturers to SAW filter-based. In addition, 2014-2016, the giant part of the above and Broadcom, Qualcomm and other chip manufacturers to acquire other filter manufacturers, a joint venture to set up a subsidiary of the production filter and other events. This shows that the future of the future of the filter market is huge, the major manufacturers are doing the relevant preparation.

This market is attracting huge capital, talent and resources, and the filter device basically relies on the status of imports, but also to the Chinese chip huge growth space, the current change, unlike in previous years, it is by the huge demand Pulling, technology subversion and the strong push of capital produced. More importantly, now the status of China's mobile phone industry and 5-10 before the completely different, and this also gave the Chinese filter device suppliers to provide a golden opportunity.

2, the challenge is greater

In the world, the main suppliers of SAW filters are TDK-EPCOS and Murata, both of which account for 60-70% of the market share; BAW filter is the main supplier of Avago and Qorvo, both occupy more than 90% market share. For Chinese manufacturers, the biggest challenge of filters, mainly patents and processes. The following is the module can be integrated in several high-performance filter technology before the 100 patent distribution of the manufacturers, which is hard to find the Chinese manufacturers figure.

Terminal filter domestic market is huge, especially the domestic mobile phone manufacturers 4G high penetration rate, the added value of the filter is higher than the global average, is expected in 2020 the domestic filter market is expected to exceed 50 billion yuan.

But the current domestic enterprises in the field of filter technology is still weak, and the filter technology is still the giant company and even the country's core technology, Western developed countries and companies will block China's technology. In the field of SAW filter, the major domestic manufacturers, including CLP 26, CLP Deqing Huaying as the representative Amotech of the research institutes, Wuxi and other electronics companies, research institutes, mainly for military communications terminal equipment. Wuxi good electronic SAW filter products in the mobile phone to achieve sales, customers include ZTE, Yulong, Jin Li, Samsung, Sapphire, Foxconn, Meizu and so on.

In addition, A-share listed companies in the McNair technology through the cut into the SAW filter production, there are some companies may have the relevant production process or industrial chain resources, do not rule out the future through the extension or self-developed way into the field. For the Chinese filter business, in the design, processing and integration and other aspects, there are still many difficulties yet to be a breakthrough, we must step into the technical and talent accumulation. We need to design, processing and integration and other forces together to work together to speed up the process of localization of the filter.

Summary: Although the domestic filter, both in the base station side or the terminal side and the developed countries have a certain gap, but with the 4G era of continuous innovation and follow-up and 5G communication standards brought about by changes in domestic enterprises is expected to gradually cut a striking figure.

The future world is a wireless connection to all the world. According to Gartner predicts that by 2020, networking equipment will reach 25 billion, to achieve the global average of three people the size of network equipment. As an indispensable part of the wireless connection, the RF front-end technology innovation is one of the core engines that drive the wireless connectivity forward. In the wireless networking terminal equipment from 2015 to 3.6 billion to 25 billion trend, the RF front-end device will increase the annual output value several times.

Filter is the RF front-end market, the largest business segment, the filter's main role is to transmit and receive signal filtering, the signal can be a specific frequency components through, and greatly attenuate the other frequency components, reduce the interference of the signal The In a radio frequency circuit, the role of the filter is to allow a specific frequency of the signal through, and then try to suppress other frequencies of signal interference. Usually the frequency of 1900Mhz below the frequency of SAW, the higher frequency band with BAW.

SAW is a surface acoustic wave filter, at the input by the piezoelectric effect of the wireless signal into an acoustic signal on the surface of the media propagation, the output by the reverse piezoelectric effect of the acoustic signal into a wireless signal. SAW filter set low insertion loss and good suppression performance in one, not only can achieve wide bandwidth, its volume is still much smaller than the traditional cavity and even ceramic filter, but because of SAW filter has limitations. , Higher than 1Ghz, the selective reduction in the 2.5Ghz, it can only meet the performance requirements of the application is not high, this time on the need for BAW.

In general, the phone for each support a band, you need to add two filters were used to receive and send signals, the current market common 5-mode 13-band 4G mobile phone, in addition to the 2/3 / 4G signal Send and receive filtering, but also need to Wi-Fi, Bluetooth, GPS signal filtering, so a phone about 30 or so for different bands of the filter. Therefore, in order to use such a number of filters in a limited mobile space, it is necessary to integrate the filters of these different operating frequency bands.

Technology giant QUALCOMM predicts that the filter market will grow from $ 5 billion in 2015 to $ 13 billion in 2020.

As far as the LTE R11 version of 3GPP proposed by the Global 3G Standards Association in 2012, the number of bands supported by cellular communications systems has increased to 41. In the future, the RF filter market will usher in more growth. With 4G mature and 5G coming, 3GPP version will be upgraded to R16, mobile phone support the number of bands increased significantly.

Now, the cost of RF devices in mobile phones is getting higher and higher, a 4G full Netcom phone, front-end RF chip cost has reached 8-10 dollars, containing 6-10 filters. The future with 5G arrival, RF kit cost is likely to exceed the main chip of the phone. And the outbreak of things, it is the RF devices, especially the demand for filters to add fuel to the flames.

With the 4.5G network and 5G network landing, mobile communication frequency band will increase significantly (generally need to be backward compatible), driven by the demand for filter growth. Specifically: 2G to 4G, the common frequency band from 4 to nearly 20 (need to be backward compatible), the number of mobile phone filters from just a few to the whole version of the network version of IPhone6S 40, the future 5G demand will Bigger. While considering the Internet of things access, other new near-field connection, filter demand will increase.

Filter opportunities and challenges

1, unprecedented opportunities

At present, the terminal filter market demand doubled, driving factors mainly from several aspects: 1,4G mobile phone market in the overall penetration rate increase; 2,4G technology evolution (including carrier aggregation), the relevant band continues to increase; 3 , The Internet of things to broaden the horizontal market; 4,5G potential band and access to the upgrade. 2015 SAW filter only global market of 20 billion US dollars, is expected to 2016 more than 3 billion US dollars, the market growth rate of more than 50%, taking into account the BAW filter and 2018 5G band gradually divided, the market space will be doubled increase.

By 2020, the value of the filter unit phone or more than 5 US dollars / Department (the current 4G mobile phone about 3.75 US dollars / min), corresponding to the market nearly 10 billion US dollars, is expected to more than 50 billion yuan. So the market demand driven to become the core of the filter industry growth logic, the relevant drivers may gradually promote the future market space growth.

Filter market because of the need for technical accumulation and market space reasons, the competitive landscape for the oligarchs. From the shipments of the situation, the US manufacturers Avago, Qorvo, Skyworks and Japanese manufacturers TDK, Murata, the sun as the main manufacturers. One of the US manufacturers have to provide front-end module solutions and provide the ability to provide BAW filter, the Japanese manufacturers to SAW filter-based. In addition, 2014-2016, the giant part of the above and Broadcom, Qualcomm and other chip manufacturers to acquire other filter manufacturers, a joint venture to set up a subsidiary of the production filter and other events. This shows that the future of the future of the filter market is huge, the major manufacturers are doing the relevant preparation.

This market is attracting huge capital, talent and resources, and the filter device basically relies on the status of imports, but also to the Chinese chip huge growth space, the current change, unlike in previous years, it is by the huge demand Pulling, technology subversion and the strong push of capital produced. More importantly, now the status of China's mobile phone industry and 5-10 before the completely different, and this also gave the Chinese filter device suppliers to provide a golden opportunity.

2, the challenge is greater

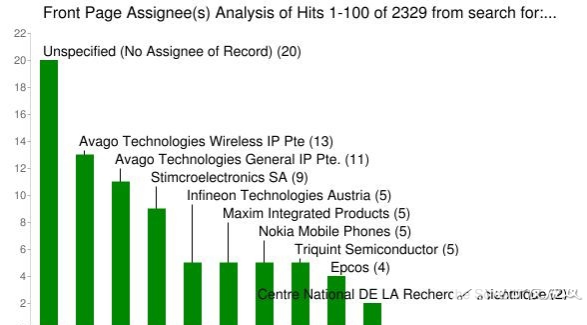

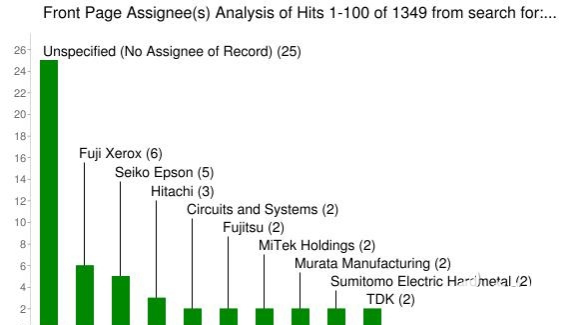

In the world, the main suppliers of SAW filters are TDK-EPCOS and Murata, both of which account for 60-70% of the market share; BAW filter is the main supplier of Avago and Qorvo, both occupy more than 90% market share. For Chinese manufacturers, the biggest challenge of filters, mainly patents and processes. The following is the module can be integrated in several high-performance filter technology before the 100 patent distribution of the manufacturers, which is hard to find the Chinese manufacturers figure.

A total of 2329 BAW-related filters in the United States Patent: Top 100 Patent Applications

Terminal filter domestic market is huge, especially the domestic mobile phone manufacturers 4G high penetration rate, the added value of the filter is higher than the global average, is expected in 2020 the domestic filter market is expected to exceed 50 billion yuan.

But the current domestic enterprises in the field of filter technology is still weak, and the filter technology is still the giant company and even the country's core technology, Western developed countries and companies will block China's technology. In the field of SAW filter, the major domestic manufacturers, including CLP 26, CLP Deqing Huaying as the representative Amotech of the research institutes, Wuxi and other electronics companies, research institutes, mainly for military communications terminal equipment. Wuxi good electronic SAW filter products in the mobile phone to achieve sales, customers include ZTE, Yulong, Jin Li, Samsung, Sapphire, Foxconn, Meizu and so on.

In addition, A-share listed companies in the McNair technology through the cut into the SAW filter production, there are some companies may have the relevant production process or industrial chain resources, do not rule out the future through the extension or self-developed way into the field. For the Chinese filter business, in the design, processing and integration and other aspects, there are still many difficulties yet to be a breakthrough, we must step into the technical and talent accumulation. We need to design, processing and integration and other forces together to work together to speed up the process of localization of the filter.

Summary: Although the domestic filter, both in the base station side or the terminal side and the developed countries have a certain gap, but with the 4G era of continuous innovation and follow-up and 5G communication standards brought about by changes in domestic enterprises is expected to gradually cut a striking figure.