The current GaAs / GaN compound semiconductor RF devices have been used in 4G communications, active phased array radar, satellite communications and other fields. However, the existing market mainly by Japan, the United States, Europe, compound semiconductor companies to control, and has established market and technical barriers to form the industry chain inertia. Chinese enterprises to enter the market late, it is difficult to have enough voice. 5G communication will be the fastest in 2020 to achieve commercial, China is the world's largest 5G market, and began to have the global 5G communications development of the right to speak. Coupled with China has a certain technology accumulation and industrial base, the Chinese compound semiconductor industry is expected to achieve a breakthrough in the 5G communications market.

5G smart phones will make extensive use of GaAs RF devices. GaAs RF power amplifiers have a higher operating frequency than Si devices. With the continuous improvement of mobile communication frequency, Si devices can not meet the performance requirements, 4G smart phones in the power amplifier has been used in all GaAs technology. Future 5G communications will include more than 6 GHz band, superior performance GaAs devices will be irreplaceable. 5G communication to support the communication band will be significantly increased to 50 or more, much larger than the number of 4G communication band (no more than 20). Each additional 1 band needs to add an amplifier (or significantly increase the complexity of the device), making a single cell phone GaAs device costs increased significantly. CCIDIC expects the GaAs device market to reach $ 13 billion in 2020.

5G communication base stations need more high-performance GaN RF devices. GaN RF power amplifier combines the high power of Si devices and the high frequency characteristics of GaAs devices. In order to cope Silver Wing with the rapid decline in the efficiency of Si devices in the 2.4 GHz band, 4G communication base stations began to use GaN power amplifiers. At present, about 10% of the base station uses GaN technology, accounting for more than 50% of the GaN RF device market. The future 5G communication frequency up to 85 GHz, is the band to play the advantages of GaN, making GaN as 5G core technology. The global annual new about 1.5 million base stations, the future 5G network will also cover the smaller coverage area, more dense distribution of micro-base stations, the demand for GaN devices will increase significantly. CCIDIC expects the RFID market to exceed $ 600 million by 2020.

Developed countries have completed the strategic layout, and the implementation of China's technology blockade

Developed countries have completed the strategic layout of compound semiconductors. As the compound semiconductor has excellent performance and broad application prospects, the United States and Europe in the early 21st century has begun to layout, release technology and industry support programs, and cultivate a number of leading enterprises, has occupied the technology and market high ground, for 5G communication Development laid the foundation. The US Department of Defense Advanced Research Projects Agency (DARPA) has released a wide band gap compound semiconductor technology innovation program (WBGSTI program) and next-generation GaN electronic device program (NEXT program) from 2002 to help the United States, such as Qorvo, Cree and other compound semiconductors Enterprises quickly grow into industry leaders. The European Defense Agency (EDA) released the MANGA program in 2010 to ensure the safety of the compound semiconductor supply chain in the European region.

International giants dominate the semiconductor market for compound semiconductor RF devices. 4G smart phones with the GaAs RF amplifier market, the United States Skyworks, Qorvo and Broadcom three companies market share close to 90%. GaN base station market concentrated in Japan Sumitomo Electric, the United States Cree and Qorvo three companies in the hands. In terms of manufacturing maturity, Qorvo has shipped 2.6 million GaN devices since 2008, of which 170,000 are used in radar. Cree company in early 2014 announced its GaN RF device cumulative sales of more than 1 million.

Qorvo and Raytheon's GaN products have reached the US Department of Defense's Manufacturing Maturity Assessment (MRL) Levels 9 and 8, respectively. Grade 9 means that the GaN device manufacturing process has met the performance requirements of the best performance, cost and capacity, ready to start full rate production.

International implementation of China's core technology blockade, the industry chain facing the risk of sanctions embargo. First, the military use of compound semiconductors makes the United States frequently hinder the rise of domestic industries. The compound semiconductor is the core component of military equipment such as active phased array radar, millimeter wave communication, military satellite, laser weapon and so on, and is regulated by international "Wassenaar arrangement". China's capital to buy foreign outstanding compound semiconductor companies to quickly access to talent and technology, but frequently encountered the US government hindered. Since 2015, the Jinsha River company acquired the United States Lumileds, San An Optoelectronics acquisition of the United States GCS, Fujian macro fund acquisition of Germany Aixtron were the United States to endanger the national security grounds to be rejected. Second, the domestic 5G communications machine enterprises are facing the risk of sanctions. Domestic compound semiconductor products are not yet mature, making a large number of machine imports of foreign devices, supply chain security there is a big hidden danger. In March 2016, the US Department of Commerce in violation of US export control regulations on the grounds of sanctions on ZTE, the enterprise caused a nearly devastating blow. The semiconductor-based power amplifiers, optical communication chips, etc. are in the restricted catalog. In March 2017, ZTE settled a fine with nearly $ 1.2 billion in fines with the US government.

China began to have the world's 5G communications development of the right to speak for the compound semiconductor to provide a broad market. China is an important global mobile communications market, Huawei, ZTE is the world's second largest and fourth largest communications base station suppliers, Huawei, OPPO, vivo is the world's top five smart phone business. China has built the world's largest 4G network, the number of base stations more than 2 million, the number of users exceeded 500 million. Independent brand smart phone annual shipments of nearly 500 million. Skyworks, Qorvo and other compounds Semiconductor companies in China's sales accounted for more than 60% of total sales.

In 2013, China set up IMT-2020 (5G) promotion group, and strive to become the world's 5G standard-setting leader. China's Polar Code is one of the 5G control channel coding schemes adopted by the international communication standard organization 3GPP.

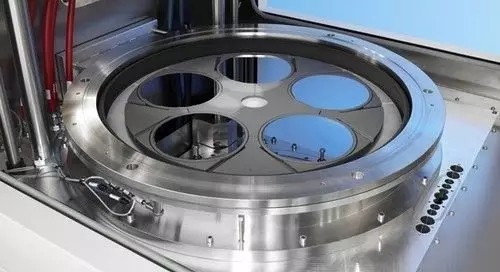

China has a certain compound semiconductor manufacturing technology reserves and industrial base. First, universities and research institutions are accelerating the industrialization of technology. Chinese Academy of Sciences, Peking University, CLP Division 13, 29, 55 and so on in the field of compound semiconductor with strong strength, relying on military and other markets have accumulated technology and talent, through technological transformation and cooperation set up in the crystal, China and other enterprises. Second, LED chips and compounds semiconductor manufacturing process similar to provide an industrial base. LED is based on compound semiconductor optoelectronic devices, in the substrate, epitaxial and device links with technical interoperability. China LED chip industry occupies an important position in the world, industry supporting more mature, can support the development of compound semiconductor industry. National IC industry investment fund has been involved in LED chip leading enterprises San An photoelectric company, investment in new compound semiconductor production line, planning capacity of 36 million / year.

Domestic GaAs design enterprises continue to emerge, is actively developing 4G products. China currently has all kinds of mobile phone power amplifier (PA) design of nearly 20 companies, the world, the purple show sharp, CD-only core and other enterprises to develop rapidly, shipments among the best, has been in the 2G and 3G mobile phone PA market Important market position. In the global 2G market, Han world has occupied 64% of the market share. In the global 3G market, Han China accounted for 42%. Domestic design companies are actively developing 4G PA products. Violet's sharp 4G PA was certified by Qualcomm's platform in December 2016. Han China 4G PA has achieved 5-10 customers mass production shipments, can achieve three-mode and five-mode coverage, the monthly shipments of more than 1 million units. Guangzhou wisdom microelectronics, Shenzhen National Feixiang Technology Co., Ltd., CD-chip companies have been in the GaAs-based 4G PA technology to achieve a breakthrough. The mainland design company is currently the main choice in Taiwan and other foundry factory manufacturing, with the three integrated companies and Haiwei Huachen company has built GaAs device production line to fill the mainland foundry manufacturing gaps, the future of the mainland GaAs design companies will be more inclined to entrust the mainland Foundry manufacturing, and jointly enhance the competitiveness in the international market.

- New generation of Buick at 2017 consumer electronics show in Asia

- Ajit manocha, global president and CEO of semi, was selected into the hall of fame of Silicon Valley Engineering Association

- 2018 Consumer Biometrics Market and Technology Trends

- Europe has started 5G commercial network

- Interpretation of the eight key technologies of 5G

- Qualcomm's TWS earphones move towards the era of noise reduction

- The semiconductor industry mergers and acquisitions in 2017